WHY GUARDIAN?

BRING BETTER PROTECTION TO LIFE

Our client-facing stories have been designed to make it easy

for you to explain the unique features and definitions of our policies.

SIMPLY DOWNLOAD AND SHARE

Each sales aid outlines a common customer scenario to demonstrate the better cover provided by a Guardian policy.

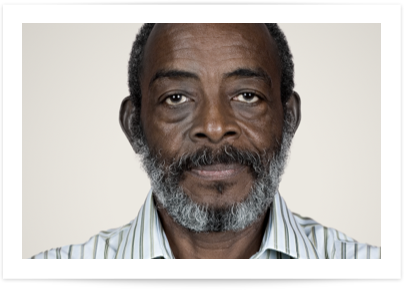

Prostate cancer

Bembe DOESN’T NEED IMMEDIATE TREATMENT SO HIS POLICY WON’T MAKE AN IMMEDIATE PAYOUT

Children’s critical illness

CRITICAL ILLNESS COVER

FOR CHEN WASN’T

AN OPTION

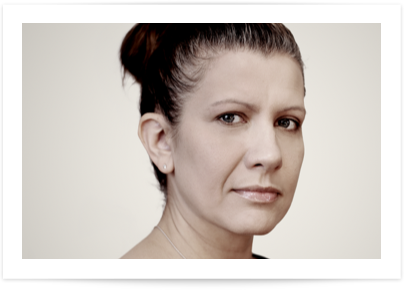

Dual life or joint life

When BECKY LOST

HER HUSBAND, SHE LOST

her life cover too

Terminal Illness

Pete doesn’t know how much longer he has to live or when his life cover will pay out

Malignant Cancer

Jane CAUGHT HER NON-MELANOMA

SKIN CANCER TOO EARLY

FOR HER POLICY TO PAY OUT

Heart Disease

Tom ONLY NEEDED ONE

STENT FITTED BUT HIS POLICY

ONLY PAYS OUT IF HE HAS TWO

Cover Upgrade Promise

WHEN LEE’S HEART

FAILED HIM SO DID

HIS INSURER

PREMIUM WAIVER

COVID-19 COST JO HER

JOB AND HER CRITICAL

ILLNESS COVER

All characters are fictitious, and their stories have been created for illustrative purposes.

BOOK A ONE-TO-ONE PRODUCT BRIEFING

To find out more about Guardian, book a product briefing with one of our Business Development Managers.

Simply complete our online booking form and we’ll call you back.